The Link Between Your Car Loan and Your Bad Credit Credit Card

The Link Between Your Car Loan and Your Bad Credit Credit Card. Your car loan and credit card are directly linked to your financial history and credit score. If you have bad credit due to late payments, bankruptcy, a consumer proposal or voluntary forgiveness, it can affect your chances of getting a car loan at a great rate. However, by using the right credit card, you can gradually rebuild your credit, making it easier to access better car financing in the future. Learn how these two elements work together and what strategies you can adopt to improve your financial profile.

18+

Partner financial institutions.

1000+

How Your Credit Card Affects Your Car Loan

Your credit card plays a vital role in your credit score, which directly impacts your ability to get a car loan. A poor credit history can make it harder to get financing and result in less favorable loan terms. Understanding these interactions allows you to adopt the right strategies to improve your credit score and get better financing.

1. How Your Credit Score Affects Your Ability to Get a Car Loan

When you make a request for car loan, lenders analyze several factors to assess your solvency and determine whether you pose a risk:

- Credit score: This is based on several factors, including your payment history, your level of debt, and the length of your credit history. The higher your score, the better your chances of getting a loan with a interest rate advantageous.

- Credit Cards and Usage History: Lenders look at how you manage your credit cards to assess your ability to repay a car loan. Good card management (on-time payments and low balances) increases your credibility.

- Presence of delays or non-payments: If your file contains late payments, a bankruptcy, a consumer proposal or a voluntary surrender, this can complicate approval of your car loan. The link between your car loan and your bad credit credit card

Damaged credit doesn't mean you can't get financing, but it can impact your terms of the loan.

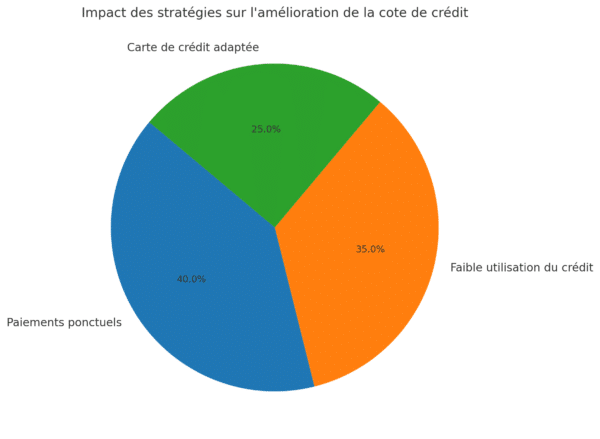

2. The importance of payment history and credit utilization ratio

There are two major components of your credit score that directly influence your ability to get a car loan:

- Payment History (35 % of Credit Score)

- Lenders want to see that you are reliable and that you meet your financial commitments.

- Just one late payment on your credit card can hurt your score and hurt your chances of getting a great car loan.

- A history of positive payments over several months or years shows that you are a responsible borrower.

- Credit Utilization Ratio (30 % of Credit Score)

- It represents the portion of your credit limit that you are using.

- Ideally, it should be less than 30 % to avoid being perceived as too indebted.

- A high utilization ratio (e.g. 80% or more of your credit limit) can make you appear overly reliant on credit and reduce your access to a car loan.

Example :

- If you have a limit of 5,000 $ on your credit card and you use 4,500 $, your ratio is 90 %, which is perceived negatively.

- If you maintain a balance of 1,000 $ on the same card, your ratio is 20 %, which is much more favorable.

Maintaining a good payment history and a low utilization ratio increases your chances of getting a car loan with better terms.

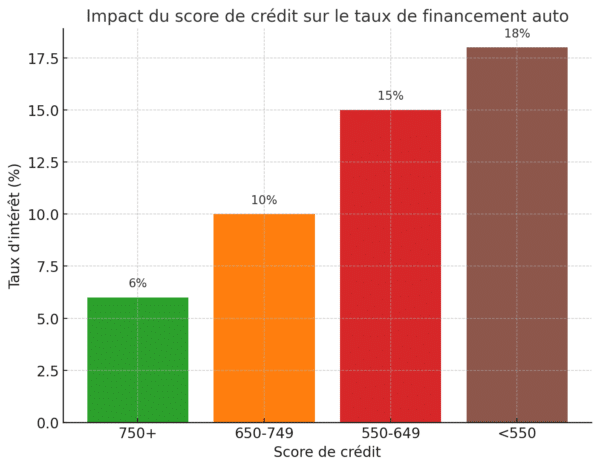

3. Why Bad Credit Leads to Higher Interest Rates

Lenders always assess risk before granting a loan. If your credit card reflects a history of late payments, high balances or financial incidents, you will be considered a risky borrower, which can lead to:

- Higher interest rates

- The lower your credit score, the more the lender compensates for the risk with a higher rate.

- Example :

- A borrower with good credit (score of 750+) can get a car loan at 6,% interest.

- A borrower with bad credit (score of 550) could receive a rate of 18 % or higher, which significantly increases the cost of the loan.

- Stricter loan conditions

- A personal contribution (down payment) may be required.

- The loan term may be shorter, resulting in higher monthly payments.

- Loan refusals

- In some cases, too damaged credit can lead to a refusal of financing, unless you go through a solution in 2nd chance, 3rd chance Or 4th chance credit, offered by specialized lenders.

In summary

Having bad credit doesn't mean you can't improve your situation. By using the right credit card and adopting good financial habits, you can rebuild your credit score and increase your chances of getting a car loan with favorable terms. Here are some key strategies to help you do just that.

1. Choose a credit card suitable for people with bad credit

If your credit file is damaged, some credit cards are designed specifically to help you restore it:

- Secured credit cards: You must deposit a collateral amount (e.g. $500), which serves as your credit limit. This reduces the risk for the lender and helps you demonstrate your reliability.

- Easy Approval Credit Cards: These cards are aimed at consumers with low credit scores, with more flexible eligibility criteria.

- Credit Cards with Rebuilding Programs: Some institutions offer cards that earn points or offer fee reductions after several months of responsible use.

👉 Tip: Choose a card that reports your payments to credit agencies, so that your positive usage is reflected in your file.

2. The importance of on-time payments to improve your financial record

On-time payments are the most important factor in calculating your credit score. Just one late payment can hurt your credit score and make it harder to get a car loan.

- Make your payments before the due date to avoid penalties and negative reports.

- Schedule automatic payments so you never miss a deadline.

- If you miss a payment, make it as soon as possible to limit the damage to your score.

Impact of late payments on credit:

- 30 Day Delay: May result in a 50-100 point loss on your score.

- 60+ Days Late: Can stay on your report for several years and hurt your future credit applications.

👉 Tip: Even if you can't pay the full balance, make at least the minimum payment to avoid being flagged as late.

3. Reduce your credit utilization rate for a positive impact on your rating

The credit utilization ratio is the percentage of your credit limit that you are using. A rate that is too high can signal to lenders that you are overly reliant on credit and therefore increase your perceived risk. The link between your car loan and your bad credit credit card.

Ideally, your utilization rate should be less than 30 %.

- Example: If your credit limit is 5,000 $, try to keep your balance below 1,500 $ (30 %).

- If you use more than 50 % of your credit, your score may be negatively affected.

Strategies to lower your utilization rate:

- Increase your credit limit (if possible) while keeping your expenses low.

- Make multiple payments per month to maintain a pay down.

- Avoid using your credit card for large purchases if you cannot pay them off quickly.

In summary

How Using Your Credit Card Wisely Can Make Your Car Loan Easier

Responsible use of your credit card can play a key role in getting a great car loan. By properly managing your payments and credit limit, you improve your credit score, which helps you qualify for better financing terms and avoid rejections. Here's how good card management can make a difference.

1. Increase your credit score before applying for a car loan

Your credit score is a major factor in your car loan approval and interest rate. Here are some best practices to improve your credit score before you apply:

- Make all your payments on time: Late payments can drop your credit score by 50 to 100 points.

- Reduce your credit utilization rate: Try to keep your balance below 30% of your limit.

- Avoid opening new credit accounts right before your loan application: Too many new applications can temporarily lower your score.

- Ask for a credit limit increase: This can improve your utilization ratio, but only if you maintain a low balance.

👉 Direct impact: A better credit score allows you to obtain a car loan more easily and with more favorable conditions.

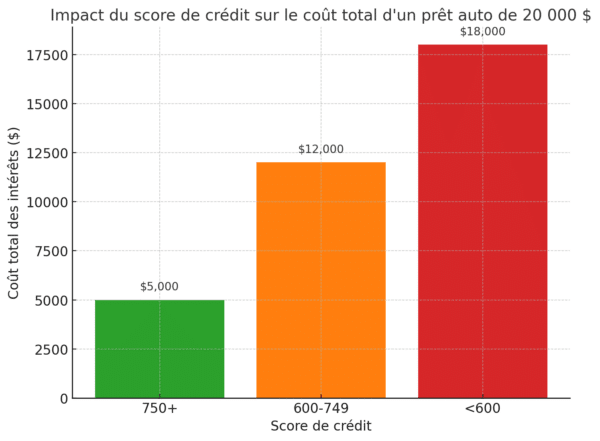

2. Access better financing conditions with improved credit

A higher credit score gives you access to lower interest rates, which can lower the total cost of your auto loan.

Example of credit score impact on a 5-year $20,000 $ car loan:

- Score of 750+ (good credit) → rate of 5 % → Monthly payments: 377 $ → Total interest cost: 2,645 $

- Score of 600 (average credit) → rate of 12 % → Monthly payments: 445 $ → Total interest cost: 6,670 $

- Score of 500 (bad credit) → rate of 18 % → Monthly payments: 507 $ → Total interest cost: 10,420 $

- These examples are for illustrative purposes only and cannot be considered when applying for funding.

👉 Good credit can save you thousands of dollars over the life of the loan.

3. Avoid mistakes that could harm your file

Even if you're working to improve your credit, there are some mistakes that can undo your efforts and make it harder to get auto financing. Here's what to avoid:

- Missing a credit card payment: A 30-day late payment can stay on your record for 6 years.

- Maxing out your credit card each month: Using more than 50 % of your limit can make it look like you're carrying too much debt.

- Multiple credit applications in a short period of time: Each application results in an inquiry that can temporarily lower your score.

- Close an old credit card: Credit history accounts for 15% of your score, so keeping an account open (even if inactive) can be beneficial.

👉 By avoiding these mistakes, you put all the chances on your side to obtain a car loan on good terms. The link between your car loan and your bad credit credit card.

In summary

Auto Financing Solutions Despite Bad Credit

Getting a car loan with bad credit can seem difficult, but there are solutions. With 2nd, 3rd and 4th chance credit options, as well as the support of a car broker specialized like Prêt Auto Québec, it is possible to finance a vehicle while working on improving its financial situation. Here's how to maximize your chances of getting financing and avoid new financial obstacles.

1. 2nd, 3rd and 4th chance credit options for obtaining a car loan

If you have a low credit score, have experienced bankruptcy, a consumer proposal, late payments or voluntary forgiveness, traditional financial institutions may decline your application. However, there are alternatives:

- Financing in second chance on credit:

- Intended for people with a credit score between 550 and 650.

- More flexible conditions than those of traditional banks.

- Slightly higher interest rates, but refinancing possible after credit improvement.

- Financing in third chance on credit:

- Suitable for borrowers with a score below 550 or who have recently experienced bankruptcy or voluntary forgiveness.

- Accepted even if there is a consumer proposal in progress.

- Specialized lenders with more flexible criteria.

- Financing in fourth chance on credit:

- Last solution for borrowers with multiple refusals.

- Loans made based on income and job stability, rather than credit score.

- May require an initial deposit or vehicle as collateral.

👉 Tip: Even though these options are available, it is recommended to gradually improve your credit score to refinance your loan at a more advantageous rate in the future.

2. The role of a broker like Prêt Auto Québec in finding the best solution

An auto financing broker, like Prêt Auto Québec, can greatly facilitate access to auto credit for people with a bad credit history.

Here's why working with a broker is beneficial:

- Access to a vast network of lenders: More than 20 financial institutions, including lenders specializing in 2nd, 3rd and 4th chance credit.

- Personalized assessment: An expert analyzes your file and finds the best options suited to your situation.

- Negotiating better terms: Brokers can obtain lower rates and more flexible repayment terms.

- Complete support: From the submission of your file to the approval and delivery of the vehicle.

👉 Why it matters: A broker saves you from having to apply for multiple loans, which could further harm your credit score.

3. Plan smart financing to avoid further financial difficulties

Getting a car loan with bad credit is an opportunity to rebuild your financial record, but it's essential to manage your financing well to avoid making your situation worse. The link between your car loan and your bad credit credit card.

Here are some tips for successful auto financing:

- Avoid taking out too high a loan: Choose an affordable vehicle so as not to increase your debt.

- Make monthly payments: Being late can hurt your credit score even more.

- Monitor your credit regularly: Check your credit report and correct any potential errors.

👉 Objective: Use the car loan as a lever to improve your financial situation and access better conditions in the future.

In summary

Get your car loan now.

We can help you.

To reach us by phone, dial:

info@www.pretautoquebec.ca