Auto loan amortization calculation

18+

Partner financial institutions.

1000+

Understanding Car Loan Amortization

Car loan amortization is a key concept for any borrower who wants to understand how their payments are spread out over time. It directly impacts your monthly payments and the total cost of your financing. Here’s a detailed explanation of the basics, how it impacts your payments, and the differences between a fixed and variable amortization loan.

1. Definition and basic principles of depreciation

Depreciation is the process by which the amount borrowed for a car loan is repaid gradually over time, usually through equal monthly payments. These payments cover two main components:

- Principal: The initial amount you borrowed.

- Interest: The fee paid to the lender for the use of borrowed funds.

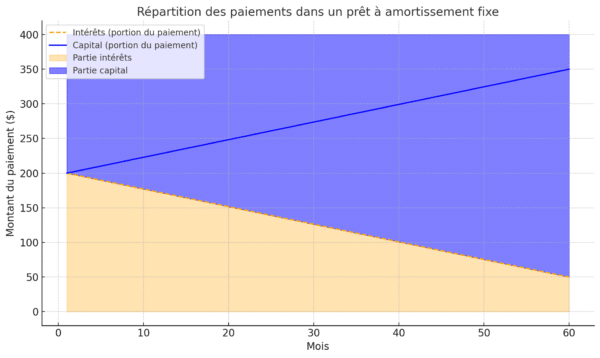

At the beginning of the loan, a large portion of each payment goes toward interest, while a small portion reduces the principal. Over time, this distribution reverses: an increasing portion of the payment goes toward the principal, while interest decreases.

2. How amortization affects your monthly payments

The amount of your monthly payments depends on several factors, including:

- There loan term : A longer loan term reduces monthly payments, but increases total interests.

- Interest rate: The higher the rate, the larger the interest portion of your payments will be at the beginning.

- THE amount borrowed : A higher amount results in higher payments and increased interest.

Here's how depreciation affects your finances:

- Loans with shorter terms allow you to repay the principal more quickly, but require higher monthly payments.

- Conversely, a longer term decreases monthly payments, but increases the total interest paid at the end of the loan.

3. Difference between a fixed and variable amortization loan

- Fixed Amortization: Your monthly payments remain constant throughout the loan. This model is ideal for borrowers who prefer stability and predictability in their budget.

- Variable amortization: Your payments fluctuate based on changes in the interest rate. If the rate goes down, your payments go down, but if it goes up, your payments will be higher. This is best for those who can handle fluctuations in their budget. Note that if you get your loan through a broker or dealership, your payment will not change. Instead, the amortization will.

4. Chart: Example of amortization for a car loan

Here's a chart showing how payments are split between principal and interest over time in a fixed-amortization loan.

In summary

During the car loan calculation, several elements play a crucial role in determining your monthly payments, from total cost of loan and the repayment period. Here are the main factors to consider:

1. Main factors: interest rate, loan term, amount borrowed

- Interest rate : It determines the portion of payments allocated to interest. A high rate increases the total cost of the loan, while a low rate reduces this cost.

- Loan Term: A longer term decreases monthly payments but increases total interest paid, while a shorter term decreases interest but increases monthly payments. Auto Amortization Loan Calculator,

- Amount Borrowed: The total amount you borrow, including taxes and other fees, directly influences your payments and interest.

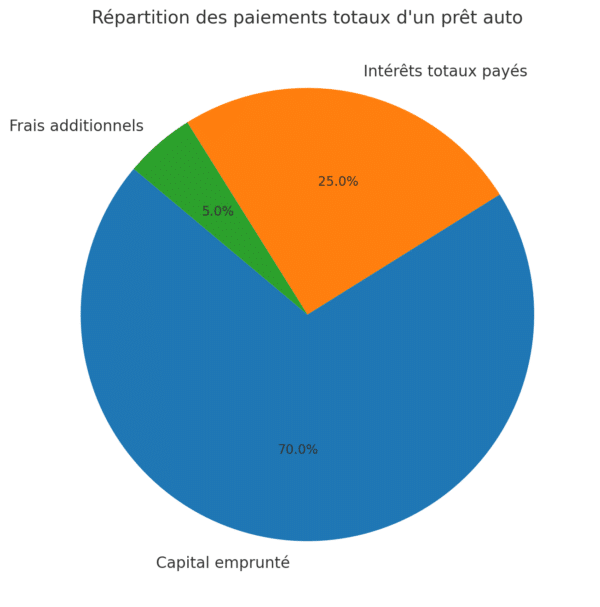

2. Impact of additional costs (insurance, extended warranties, etc.) on the total cost

Additional costs associated with purchasing a vehicle can significantly increase the total cost of the auto loan:

- Loan Insurance: May be included to cover payments in the event of illness, disability or death.

- Extended warranties : Provide additional coverage for repairs, but add to the amount borrowed.

- Administration or registration fees: Often included in the loan, they increase the capital to be repaid. These fees must be taken into account to avoid surprises and properly assess the overall cost.

3. The importance of knowing the total cost of your loan

Understanding the total cost of your loan is essential to avoid financial surprises. This includes:

- Total Interest Paid: The total amount of interest over the life of the loan.

- Total Amount Repaid: Includes the principal borrowed and all associated fees.

- Realistic Monthly Payments: Considering your budget, make sure payments are manageable throughout the term of the loan.

Illustrative Chart: Breakdown of Total Car Loan Payments (Principal and Interest)

The chart below shows the breakdown between principal borrowed and interest paid on a typical auto loan.

In summary

Tools and methods for calculating a car loan with amortization

1. Using an online calculator

Online calculators are convenient, easy-to-use tools for estimating your monthly payments and the total cost of a car loan. By entering information such as loan amount, interest rate, and amortization term, these tools provide immediate results, including:

- Monthly payment amount: Helps you assess whether the loan fits into your budget.

- Total Interest Cost: Shows how much you will pay on top of the amount borrowed.

- Amortization Table: Some calculators offer a detailed overview of the distribution between principal and interest for each payment. These tools are particularly useful for comparing different financing offers and choosing the one that suits you best.

2. Explanation of mathematical depreciation formulas

For those who want to understand the math in detail, here is the mathematical formula used for a fixed payment loan:

M=P⋅r⋅(1+r)n(1+r)n−1M = \frac{P \cdot r \cdot (1 + r)^n}{(1 + r)^n – 1}

Or :

- M = Monthly payment

- P = Loan amount (borrowed capital)

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (loan term in months)

This formula shows how payments are calculated taking into account principal, interest rate, and term. While this method is less intuitive than online calculators, it provides a clear understanding of the mathematical basis of amortization.

In summary

Optimize your car loan through amortization

Car loan amortization plays a key role in managing your finances. By understanding the mechanics of amortization, you can reduce the total cost of your loan and adjust your monthly payments to fit your budget. Here's how to maximize the benefits of amortization.

1. Choose the ideal term to balance monthly payments and total interest

Choosing the loan term has a direct impact on your monthly payments and the total cost of the loan:

- Short term (36-48 months):

- Benefits: Reduction in total interest paid over the term of the loan.

- Cons: Higher monthly payments, requiring a tighter budget.

- Long term (60-84 months):

- Benefits: Lower monthly payments, providing immediate budget flexibility.

- Cons: Significant increase in total interest paid. To maximize your loan, choose a term that balances your monthly payments with your long-term financial goals. For example, if you're on a tight budget, opt for a longer term, but schedule additional payments to keep interest down.

2. Strategies to reduce interest: down payment, early repayment, etc.

Reducing interest is a priority to minimize the total cost of your auto loan. Here are some effective strategies:

- Increase the down payment:

- By paying a larger initial amount, you reduce the amount you borrow, which lowers the interest.

- A down payment of at least 20 % is recommended to maximize this effect.

- Early repayment:

- If your contract allows, make extra payments or repay some of the principal early.

- This reduces the amount of remaining capital and therefore future interest.

- Compare interest rates:

- Before signing, compare offers from different lenders to get the best possible rate.

- Prêt Auto Québec, for example, offers competitive solutions adapted to your situation.

In summary

Support from Prêt Auto Québec in your financing

Prêt Auto Québec is committed to making access to car financing simple, fast and tailored to your needs. With our expertise and tailored solutions, we help each client find a loan that perfectly matches their financial situation, no matter their challenges.

1. How Prêt Auto Québec personalizes your loan according to your budget

Every client has unique financial needs, and we understand the importance of financing that respects your reality. That’s why we:

- Let's assess your overall situation: We analyze your income, expenses and goals to determine realistic and comfortable monthly payments.

- Offer tailored options: Whether it’s a short-term loan to reduce interest or a longer term for more affordable payments, we adjust the terms to suit your preferences.

- Offer complete transparency: We explain in detail the total cost of your loan, including interest and any fees, so you can make an informed decision.

2. Flexible financing solutions, even in case of damaged credit

At Prêt Auto Québec, we believe that everyone deserves a second chance, regardless of their credit history. We work with more than 20 financial institutions to guarantee:

- Fast approvals: Even if you have been refused elsewhere, we have solutions adapted to your file.

- Financing for complex situations: Whether you are on 2nd, 3rd or 4th chance credit, or have gone through a bankruptcy or a voluntary surrender, we find a viable option for you.

- Access to a varied inventory: With more than 1000 vehicles available in inventory, we help you find a car that suits your style and budget.

3. Contact us for an accurate calculation and find the perfect option for your vehicle

Car financing can seem complicated, but our team of experts is here to simplify every step. By contacting us:

- Get a personalized estimate: We calculate your monthly payments and the total cost of your loan to give you a clear and realistic vision.

- Enjoy human support: Our specialists are available to answer your questions, guide you and help you choose the vehicle that best meets your needs.

- Speed up the online process: With our quick and easy financing application, you can submit your file in just a few clicks and get a approval in record time.

In summary