Auto financing rates

18+

Partner financial institutions.

1000+

What is a rate and how does it impact your car loan?

The auto financing rate is a percentage applied to the amount borrowed for buy a vehicle. It determines the cost you will pay on top of the borrowed capital, and plays a key role in the calculating your monthly payments and of total cost of your car loan.

1. Definition and role of the interest rate in a car loan

THE interest rate represents the price you pay to borrow money from a financial institution or private lender. Here's what it does in a car loan:

- Cost of Loan: The higher the interest rate, the higher the total cost of your loan will be. Conversely, a low rate reduces the financial burden.

- Monthly Payments: The interest rate directly affects the proportion of each monthly payment that goes to interest versus principal repayment.

- Influence on choices: It can influence the duration of the loan or the decision to opt for a new or used vehicle.

2. Difference between fixed rate and variable rate

The type of interest rate you choose impacts the stability of your payments and the overall cost of the loan:

- Fixed rate :

- The percentage remains constant throughout the term of the loan.

- Advantages: Predictable payments, financial stability, no surprises related to market fluctuations.

- Cons: May be slightly higher than initial variable rates.

- Variable rate :

- The percentage may fluctuate depending on market variations and decisions of the Bank of Canada.

- Advantages: Often lower initially, potential to save if interest rates drop.

- Disadvantages: Risk of increasing monthly payments if rates rise.

THE choice between a fixed rate and a variable rate depends on your risk tolerance and budget.

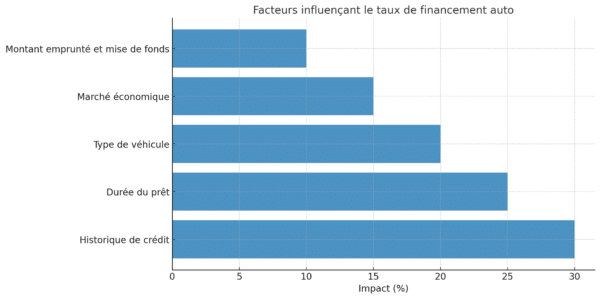

3. Factors influencing the auto financing rate

There are several factors that determine the interest rate you get on a car loan:

- Credit History:

- A good one credit score allows access to lower rates.

- A bad credit damaged may result in higher rates due to the lender's perceived risk.

- Loan duration:

- Longer loans often have higher interest rates because the risk to the lender is greater.

- Shorter loans have more competitive rates, but higher monthly payments.

- Vehicle type:

- New vehicles typically have lower interest rates due to dealer or manufacturer promotions.

- Used vehicles may have higher rates due to their lower resale value.

- Economic market:

- The Bank of Canada's interest rate decisions influence the interest rates offered by lenders.

- Amount borrowed and down payment:

- A lower borrowed amount, thanks to a down payment important, can reduce the interest rate.

In summary

The financing rate plays a central role in managing your car loan. It not only influences your monthly payments, but also the total cost of the loan over its term. Understanding its impact allows you to make informed financial choices and better adapt your budget.

1. How the interest rate affects your monthly payments

The interest rate determines the portion of each monthly payment allocated to interest and the portion devoted to repaying the borrowed principal:

- High rate: With a high interest rate, a significant portion of your monthly payments goes to interest, which slows down principal repayment and increases the total cost of the loan.

- Low Rate: A lower interest rate reduces the portion of payments allocated to interest, allowing for faster repayment of principal and a lower overall cost.

Example: For a loan of 20,000 $ over 5 years:

- At 3 % interest: Monthly payment of 359 $, total interest cost = 1,542 $.

- At 7 % interest: Monthly payment of 396 $, total interest cost = 3,760 $.

A higher rate may seem insignificant at first glance, but it significantly increases the overall cost over the life of the loan.

2. Comparison between a short-term loan and a long-term loan

The term of the loan is another key factor that influences the impact of the financing rate. Here is a comparison of the two options:

- Short term loan (24-48 months):

- Benefits :

- Significant reduction in total interest cost.

- The loan is repaid faster, allowing you to free up your budget sooner.

- Disadvantages:

- Higher monthly payments, which can put a strain on a tight budget.

- Benefits :

- Long term loan (60-84 months):

- Benefits :

- Lower monthly payments, providing greater financial flexibility.

- Ideal for those who want to minimize their immediate monthly expense.

- Disadvantages:

- Much higher total interest, increasing the final cost of the vehicle.

- Slower principal repayment, which can lead to prolonged debt.

- Benefits :

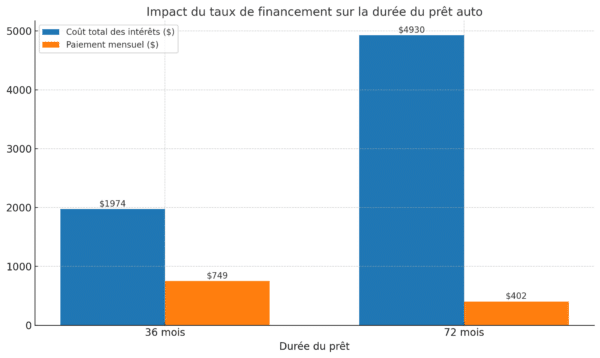

Example: For a loan of 25,000 $ with a rate of 5 %:

- 36 months: Monthly payments = 749 $, total interest = 1,974 $.

- 72 months: Monthly payments = 402 $, total interest = 4,930 $.

3. The importance of understanding the total cost of your loan

Beyond monthly payments, it’s crucial to consider the total cost of your car loan to avoid financial surprises. This includes:

- Accumulated interest: This represents a significant portion of the total cost, especially on long-term loans or those with high rates.

- Additional costs: Loan insurance, extended warranties, and other fees should also be included in your calculations to get a realistic view of the overall cost.

- Residual value: In some loans, such as long-term leases, a portion of the vehicle's value remains to be paid at the end of the contract.

Why this matters: Knowing the total cost of your loan allows you to effectively compare offers, plan your long-term finances, and choose an option that fits your financial priorities.

In summary

How to get a favorable financing rate?

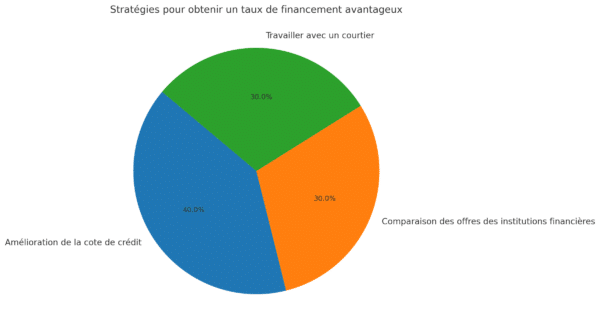

A competitive financing rate is essential to reduce the total cost of your car loan and reduce your monthly payments. Here are effective strategies for getting a great rate, tips for comparing offers and the importance of working with an experienced auto broker like Prêt Auto Québec.

1. Strategies to Improve Your Credit Score Before Applying for a Loan

Your credit score is one of the most important factors influencing the financing rate you'll get. Here are some things you can do to strengthen it before you apply:

- Set your debts In Progress: Try to pay off or reduce your credit card and other balances debts. A lower credit utilization ratio improves your credit file.

- Make your payments on time: Make sure you don't have any late payment on your bills, as this may negatively affect your credit history.

- Fix errors on your credit report: Check your credit report regularly to make sure it is accurate. Correct any errors or discrepancies that could skew your score.

- Avoid New Credit Inquiries: Limit new credit inquiries before applying for a car loan, as they can temporarily lower your score.

2. Comparison of offers from different financial institutions

Each financial institution may offer different terms and conditions interest rate different, so it is crucial to compare the available options:

- Look for dealer promotions: Car manufacturers sometimes offer very competitive promotional rates, especially for new vehicles.

- Analyze offers from banks and specialty lenders: Traditional institutions like banks often offer competitive rates for borrowers with good credit, while specialty lenders may be more flexible for those with damaged credit.

- Use a online loan calculator : Compare monthly payments and total cost for different rates and terms to better evaluate your options.

The chart illustrating the strategies for obtaining a favorable financing rate is ready.

In summary

Prêt Auto Québec solutions for tailored financing

Prêt Auto Québec specializes in supporting customers, whatever their financial situation, by offering them suitable and flexible financing solutions. Thanks to its expertise and its vast network of financial partners, Quebec Auto Loan facilitates access to a vehicle while optimizing the loan conditions to meet the specific needs of each client.

1. Flexible financing options in 2nd, 3rd and 4th chance credit

For customers with damaged credit or facing financing refusals from traditional institutions, Prêt Auto Québec offers specially designed solutions:

- Financing in 2nd chance credit : Ideal for borrowers with a slightly impacted credit history. These options offer competitive rates to help regain financial control.

- Financing in 3rd chance And 4th chance credit : Designed for clients with greater financial challenges, such as a bankruptcy, a consumer proposal or a financial recoveryThese solutions guarantee access to financing despite complex situations.

- No exclusions: Even if you have experienced several bankruptcies or are currently in the process of recovery, Prêt Auto Québec is committed to finding a solution for you. We also offer solutions to maximize your chances of obtaining a vehicle with our possibilities of a home auto financing.

2. Access to a large network of financial partners to obtain competitive rates

One of Prêt Auto Québec’s major assets is its vast network of financial partners, including:

- More than 20 financial institutions: These partnerships make it possible to explore a range of options and obtain competitive interest rates, even for customers with bad credit.

- Specialized lenders: Prêt Auto Québec works with lenders who understand the challenges of 2nd or 3rd chance credit clients, guaranteeing an approach tailored to each situation.

- Customized solutions: By comparing several offers, Prêt Auto Québec identifies the one that best suits your needs and your budget.

3. Personalized support to understand and optimize your car loan

Prêt Auto Québec doesn't just find you a loan; it also makes sure you understand and optimize every aspect of your financing:

- Complete analysis of your financial situation: Experts evaluate your income, expenses and credit history to propose realistic solutions.

- Transparent explanations: Each customer receives a clear explanation of the terms of their loan, such as interest rates, monthly payments and financing term.

- Payment Optimization: The team adjusts loan terms to ensure manageable monthly payments and avoid financial overload.

- Advice for the future: In addition to supporting you in your current financing, Prêt Auto Québec offers strategies to improve your credit rating and facilitate your future loans.

In summary

Get your car loan now.

We can help you.

To reach us by phone, dial:

info@www.pretautoquebec.ca